Welcome to 2021 - what's in store for Dunedin

2020 - what the hell

2020 was an historic year. Covid took on the entire world and won. It will be remembered for one of the greatest losses of human life in history. At the time of writing this there has been over 100 million cases of Covid19 worldwide and over 2 million deaths. There may also be a footnote stating the the 45th US President was a reality TV star and narcissistic megalomaniac but hopefully he is clouded by the dust of Covid19.

New Zealand in the spotlight

As of 30th January 2021, New Zealand has had 2300 cases and 25 deaths. The quick and decisive leadership of the health professionals and our Prime Minister mean we have largely controlled the outbreak. New Zealand has gotten off very lightly and has been held up to the world as a global leader in dealing with Covid19. Never before has the spot light so strongly be shone on our little island nation of Aotearoa. Every media outlet from Jimmy Kimmel, to CNN, to the Joe Rogan Experience has been singing our praises.

The safest place in the world

For a long time Aotearoa has been seen as the safest place in the world to live. Despite a global pandemic the stock markets and property markets have been booming. COVID19 has been great for the middle class and wealthy. It has meant more time at home with those we love, and increase in equity in our homes and stock portfolios, and generally a better appreciation of what is really valuable in life. The fundamental value of New Zealand is very high. We have a lot beautiful space, we have a small population, we are hidden away in the corner of the world away, we care about our population and believe in education and health care for everyone.

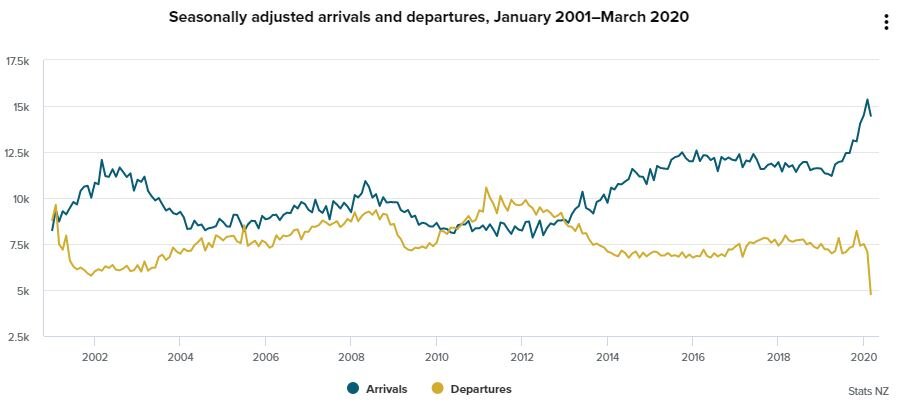

As a brand, New Zealand couldn’t be in a better place at a better time. The growing awareness of New Zealand can be seen in the immigration numbers with a gap between arrivals and departures steadily increasing since 2012. In March 2021, the departures dropped to almost zero when Covid19 struck but arrivals have remained strong. The data beyond this point is incomparable because of the world Pandemic that is Covid.

Source: https://www.stats.govt.nz/information-releases/international-migration-march-2020

A period of wealth generation not seen in 100 years

I believe the resulting impact of Covid19 will see the greatest generation of wealth for New Zealanders in my lifetime. We are entering a 50 year period of growth that will exceed the post world war 2 boom experienced by our parents and grandparents. We are already seeing the start of it. Property prices are booming. Rental demand is through the roof. Everyone wants to live in or own a piece of New Zealand.

Locations such as Queenstown will skyrocket. I predict that within 50 years the Queenstown Lakes district with have the 2nd largest population in New Zealand. This will be followed by all those locations that are seemingly undervalued. Know where better can this be seen than in Dunedin. In my opinion the most undervalued location in New Zealand. Dunedin has never been first for any reason (except perhaps Albatross') but is 2nd or 3rd for many things. We have very few gold medals but when you add up all the silvers and bronzes you see a very strong performer.

Dunedin has never grown quickly. There has been a net population growth of less than 500 people per year for the past 100 years (<0.5%). In 2020 however, jobs, relatively affordable homes, and a high standard of living is attracting people from Queenstown, Auckland, and expats returning from overseas. Suddenly Dunedin is taking off.

It couldn't be a better time to invest in Dunedin. The difference between Dunedin and other towns that it has; old money, a tertiary hospital, NZ’s best university. This means jobs, and cashflow for businesses and rentals.

buying rental property investment in dunedin

At Dunedin Property Management we don’t sell property but we can help you in your decision making and in getting a mortgage. We can provide a Professional Rental Appraisal that you can use to do your numbers and present your case to your mortgage broker. If you’d like that then contact us below.